《2020年国际白银价格预测报告》系列之二

Nikos Kavalis 金属聚焦的创始合伙人

Introduction & market backdrop

简介和市场背景

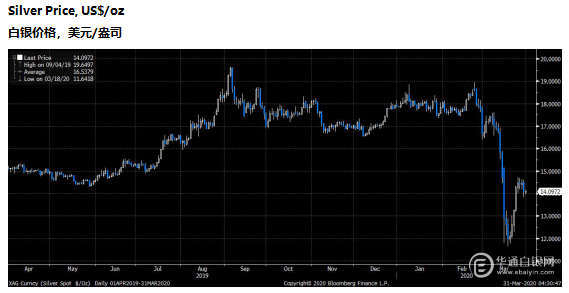

Similar to most other markets, the COVID-19 crisis has had a profound impact on silver, shaping investor behaviour, affecting producer and consumer capacity and limiting trade routes. In turn, all this has translated into heightened price volatility. After trading sideways for the early part of the year, mostly within a $17.50-18.50 range, silver suffered heavy liquidations from late February through to mid-March. The rapid spreading of the crisis to key European economies and the US resulted in panic selling across all markets. This also hit gold and silver, the latter falling to its lowest point in more than a decade.

与大多数其他市场一样,新型冠状病毒危机对白银市场也产生了深远的影响,影响了投资者行为以及生产和消费能力,并限制了贸易路线。这一切反过来又加剧了价格波动,银价在年初横向盘整,大多在17.50-18.50美元的区间内,但在2月下旬至3月中旬,白银价格遭遇了大规模的平仓。危机迅速蔓延至欧洲主要经济体和美国,导致所有市场出现恐慌性抛售。这也打击了黄金和白银,后者跌至10多年来的最低点。

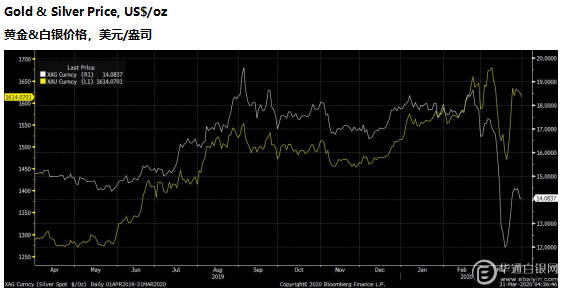

Silver has also performed poorly relative to gold recently. The gold:silver ratio rose to an all-time high of 127 on March 18, although it has more recently returned to a 110-115 range. This is still much higher than the 80-90 range it traded within for most of 2019. In addition to being less appealing as a safe haven investment than gold, we believe that silver has also suffered as a result of its link to base metals and the weakening outlook for its fundamentals.

与黄金相比,白银近期的表现也不佳。金银比在3月18日升至127的历史高点,不过近期又回到了110-115的区间。这仍远高于其在2019年大部分时间交易的80-90区间。除了作为避险资产的吸引力不如黄金,我们认为:白银与基本金属的联系,以及其基本面前景的走弱,也令其受到了影响。

Gold: Silver Ratio

金银比

All this follows a period in 2019 and early 2020, when silver prices had enjoyed strong gains. Over the summer months, the dollar spot price rallied by 37%. Although many of these gains were lost later, the metal still ended the year 15% higher than it started it. Local prices in Mainland China fared even better, with the Ag(T+D) price on the Shanghai Gold Exchange rallying by 19% over the year.

所有这一切都发生在2019年和2020年初,当时银价涨势强劲。2019年夏季,白银美元现货价上涨了37%。虽然许多涨幅后来被抵消,但年底白银价格仍比年初高出15%。中国大陆的本地价格表现更佳,上海黄金交易所(Shanghai Gold Exchange)的白银T+D价格年内上涨了19%。

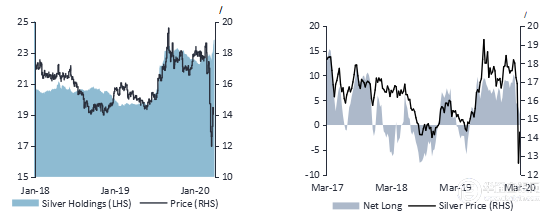

These trends have been broadly in line with silver professional investment activity. Money managers’ net positions in Comex silver futures had been elevated, ever since they shot up from a net short of nearly 6,000 tonnes to a net long of a little less than 10,000 tonnes over the summer months of 2019 They then reached their highest level since 2017 in late February, rising to 10,257t, before collapsing to 2,179t by late March.

这些趋势大致上与白银投资活动一致。基金经理在Comex银期货的净头寸一直在增加,从2019年夏季的近6000吨净空头增至略低于1万吨的净多头。随后,他们在2月下旬达到自2017年以来的最高水平,升至10257吨,然后到3月下旬暴跌至2179吨。

Silver ETP holdings, Thousand Tonnes Comex Managed Money Net Position

白银ETP持有量,千吨 Comex管理资金净头寸

ETF holdings have fared better recently. During the summer of 2019 they rose strongly to reach an all-time-high. They then drifted lower, but in fact during the past few days have shot up again, as bargain hunting has emerged.

白银ETF持仓量近期表现较好。在2019年夏季,它们强劲上涨,达到了历史最高水平。随后价格下跌,但事实上,在过去几天里,随着逢低买盘的出现,白银价格再次飙升。

Outlook

We believe that the evolution of the COVID-19 crisis will continue to have a dramatic impact on the fate of the silver market. As far as the metal’s fundamentals are concerned, there is no doubt that industrial demand, which is the single biggest source of silver consumption, as well as jewellery and silverware will all suffer this year.

我们相信,新型冠状病毒危机的发展将继续对白银市场的命运产生重大影响。就白银的基本面而言,今年,作为白银消费最大单一来源的工业需求以及珠宝和银器,无疑都会受到影响。

However, these declines should be partly offset by a rise in demand for bars and coins. Silver’s price decline as well as concerns about the future of the global economy have seen a strong rise in retail investor appetite and this should continue for the foreseeable future.

然而,这些下降应该会被银条和银币需求的上升部分抵消。银价的下跌,以及对全球经济前景的担忧,导致散户投资者的需求强劲上升,在可预见的未来,这种情况应该会持续下去。

Moreover, movement restrictions and industry shut-downs in order to keep the spread of COVID-19 under control are also affecting silver mining. We expect supply will decline this year as a result. Overall, the silver market should be in a supply surplus in 2020, but the size of that surplus is likely to actually be smaller than those seen in the previous two years.

此外,为控制新型冠状病毒的扩散而采取的行动限制和工业停产也影响到了白银开采。我们预计今年的供应会因此减少。总体而言,2020年白银市场应该处于供应过剩状态,但这种过剩的规模实际上可能小于前两年。

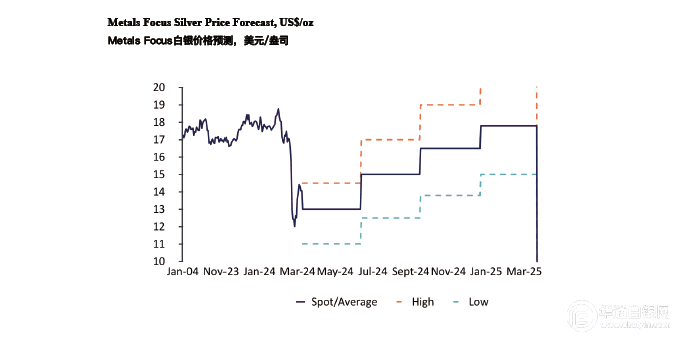

As far as the price outlook for silver is concerned, we believe that the metal will continue to be guided by gold’s performance. Specifically, we expect prices for both metals will rise from current levels, mainly in the second half of the year. Factors contributing to this will include exceptionally loose monetary and fiscal policy by authorities around the world and concerns towards the outlook of key economies, as the effects of the COVID-19 crisis are felt for months to come.

就银价前景而言,我们认为银价将继续受到金价走势的指引。具体而言,我们预计这两种金属的价格将从目前的水平上涨,主要是在下半年。造成这种情况的因素将包括世界各国政府极其宽松的货币和财政政策,以及对主要经济体前景的担忧,因为新型冠状病毒危机的影响将在未来持续数月。

Moreover, we believe that silver will outperform gold in 2020. This reflects its recent underperformance making it historically undervalued. Once investors feel comfortable that gold is in a secular uptrend, we would expect many of them will be drawn to silver, this in turn resulting in its price “catching up” with that of gold. Silver should also be helped by a relief rally in industrial commodities, that have suffered heavy liquidations in recent weeks.

此外,我们认为:2020年白银的表现将超过黄金。这反映出白银近期的表现不佳,使其在过去被低估。一旦投资者认为黄金处于长期上涨趋势,我们预计他们中的许多人会被白银吸引,进而导致白银价格“追上”黄金价格。最近几周,工业大宗商品遭遇了大规模的平仓,而工业大宗商品价格的反弹也应有助于银价。

Throughout the year we believe that there will be scope for significant corrections. This is premised on the assumption that volatility across other markets will remain high and, as a result, investors will be forced to make liquidations across all assets to raise cash at times. As a result, the bottom of our forecast trading range has been kept low through to the end of 2020.

在这一年里,我们相信会有很大的调整空间。这一假设的前提是,其它市场的波动性将仍保持高位,因此,投资者将被迫对所有资产进行清算,以不时筹集现金。因此,我们预测交易区间的底部一直保持在低水平,直到2020年底。

(中国白银网)