《2020年国际铂钯价格预测报告》系列之六

约克大学计量经济学学士学位和伦敦经济学院计量经济学和数理经济学硕士学位、Metals Focus的创始合伙人之一 — Nikos Kavalis

Introduction & market backdrop

简介及市场背景

The platinum and palladium markets are particularly exposed to the evolving COVID-19 crisis. Lock-downs around the world have already caused disruptions to both demand and supply of the two metals and this is something that will no doubt continue for some time to come. Meanwhile, movement restrictions have hit logistics infrastructures hard and in turn have seen supply chains break down. In turn this has resulted in heightened price volatility.

新型冠状病毒的爆发,对铂钯市场影响显著。全球各地的禁闭防范措施已经对其供应和需求造成了干扰,毫无疑问,这种情况还将持续一段时间。与此同时,物流与运输行业受到了严重的冲击,进而导致供应链中断。造成了价格的剧烈波动。

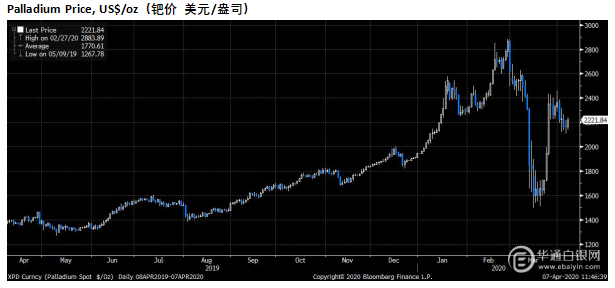

This has been particularly pronounced for the palladium price, that has had to contend with a collapse of buying and selling interest in the metal as well as a lack of appetite to take price risk, in the face of heightened uncertainty. Having peaked at over $2,880 in late February, the spot price fell to just under $1,500 by mid-March, a nearly 50% correction, at around the time of the meltdown seen across all markets. It then rebounded sharply and has traded in a $2,100-2,400 range in the few days through to the time of writing, boosted by growing evidence of supply disruptions.

这一点在钯价上表现得尤为明显。在不确定性加剧的情况下,买卖双方对这种金属的投资兴趣骤减,以及缺乏承担价格风险的意愿。现货价格在2月底触及2,880多美元的高点后,3月中旬,在所有市场都出现暴跌的时候,钯价出现了近50%的回调,跌至略低于1,500美元的水平。随后,由于越来越多的证据表明供应中断,钯价大幅反弹,在撰写本文之前的几天里,钯价一直在2100美元至2400美元的区间内波动。

Price action was similarly violent for platinum, that fell from over $1,000 in late February to a low of just over $560. That was the lowest price since 2002, something that resulted in strong physical investment across a number of key markets, including China, Japan and the US. This coupled with news of supply constraints and stronger gold prices saw platinum stage a strong recovery shortly after and has been trading in a $700-750 range more recently.

同样,铂金价格剧烈波动,从2月底的1000多美元跌至略高于560美元的低点。这是自2002年以来的最低价格,导致包括中国、日本和美国在内的多个关键市场出现了强劲的实物投资。再加上供应受限和金价走强的消息,铂金价格不久后强劲反弹,最近一直在700-750美元区间交易。

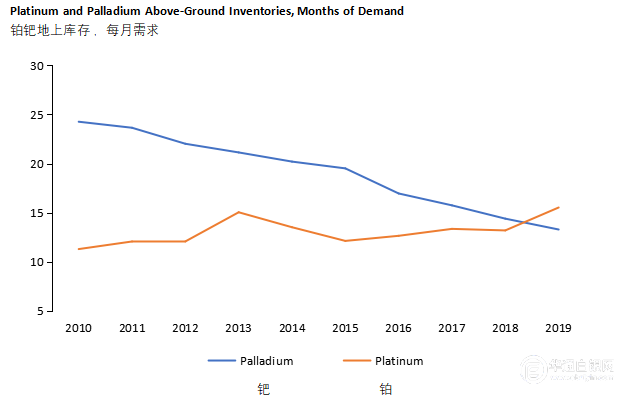

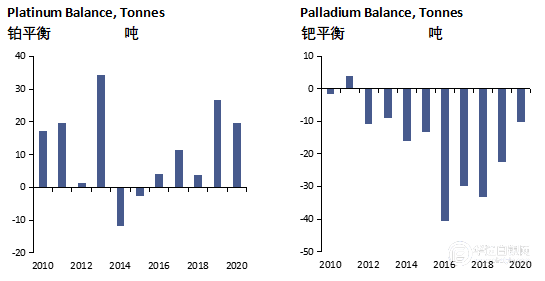

Before considering the outlook for palladium and platinum supply and demand in 2020, it is useful to provide some background on trends noted in recent years and the state of the market in 2019. Starting with palladium, the market has seen consistent deficits in recent years. Over the previous decade, these added up to nearly 173t, something that saw palladium above-ground inventories fall from being equivalent to over two years of production in 2010 to just over one year at the end of 2019.

关于2020年钯铂的供需前景,必须参考近年趋势和2019年市场状况的背景资料。钯金方面,近年来,市场出现了持续的短缺。在过去的10年里,累计接近173吨,这导致钯的地上库存从2010年相当于两年以上的产量下降至2019年底的一年以上。

This persistence of supply shortages for the palladium market has been mainly driven by robust demand from the automotive sector. In 2019, global autocatalyst fabrication reached 280t, 55% higher than our estimate for 2010. In turn this increase has been the result of tightening emissions legislation, growth of overall vehicle production and a rising market share of gasoline powertrains, which have predominantly used palladium. Demand from other applications, like jewellery, electronics and dental, has been declining, but this has only marginally offset the strong gains in automotive demand.

钯金市场供应持续短缺,主要原因是汽车行业的强劲需求。我们预计,2019年全球催化剂产量达到280吨,比2010年产量高出55%。这一增长是由于排放法规的加强、汽车总产量的增长以及主要使用钯的汽油动力系统的市场份额不断上升。来自珠宝、电子和牙科等其他应用领域的需求一直在下降,但这仅略微抵消了汽车需求的强劲增长。

Supply has also enjoyed strong gains over the past decade, but these have been less pronounced than the above-mentioned increases in demand. As a result, palladium has over time seen its supply deficit widen.

过去10年里,尽管钯金供应出现了强劲增长,但与上述需求相比增长并不明显。因此,随着时间的推移,钯的供应缺口不断扩大。

Platinum, in contrast, has suffered from surpluses over most of the past ten years. Demand for the metal has been hurt by diesel losing market share within Europe, traditionally the biggest market for palladium automotive demand. Jewellery has also come under pressure, mainly as a result of structural changes in China, which is by far platinum’s largest jewellery market. All this coupled with modest gains in platinum recycling have seen above-ground stocks rise from being equivalent to around 11 months of demand to 16 last year.

于此相反,铂金在过去10年的大部分时间里一直处于过剩状态。欧洲传统上是铂金汽车需求最大的市场,而柴油在欧洲的市场份额不断下降,给铂金需求带来了影响。迄今为止,中国是全球最大的铂金首饰需求国,由于中国的结构性变化,铂金首饰业也面临压力。再加上铂金回收的小幅增长,综合这些因素,铂金地上库存从约11个月的需求量上升至去年的16个月。

Platinum and Palladium Above-Ground Inventories, Months of Demand

Outlook

展望

As noted at the start of this report, the COVID crisis has severely impacted both consumption and production capacities for platinum and palladium. Around the world, car production plants have had to shut down to respect movement restrictions and social distancing rules implemented to thwart the spread of the virus. The second order effect of the crisis on vehicle sales will also be important, as consumers postpone car purchases in the face of uncertainty or, worse yet, unemployment. Demand for other key end-products containing platinum and palladium, such as jewellery and consumer electronics, will also suffer in this environment.

如本报告开头所述,新型冠状病毒疫情严重影响了铂钯的生产和消费能力。在世界各地,为防止病毒传播,采取了行动限制和社会距离规则等措施,造成了汽车生产工厂被迫关闭。其次,汽车消费也受到严重影响,在不确定性或者更糟的失业环境下,消费者会推迟购车。在这种环境下,首饰和消费电子产品等其它含铂和钯的关键终端产品的需求也将受到影响。

At the same time, supply is also expected to suffer noteworthy losses this year. Much of South African mine production has been affected by the country’s lock-down. Adding to this, the disruption at Anglo American Platinum’s processing plant, which was not related to the COVID outbreak but rather technical issues, will also weigh on supplies. Meanwhile, just as the challenging economic conditions faced by many consumers will limit their ability to buy new cars, it will also limit their tendency to recycle old vehicles, something that will weigh on scrap supplies.

与此同时,今年的供应预计也将出现显著减少。南非的大部分矿山生产都受到了本国封锁的影响。此外,因为技术问题,英美铂业暂时关闭其加工厂,这将对供应造成压力。与此同时,在严峻经济形势下,消费者购买新车的能力下降,继而二手汽车的回收也下降,这将对铂钯废料供应造成压力。

This makes predicting the overall outcome for these two markets in 2020 exceptionally challenging. At this stage, it looks likely that the declines in PGMs demand will outweigh those of supply, particularly when it comes to palladium. Moreover, as the starting point of platinum is sizeable oversupply, this will most probably remain in place in 2020 overall. In contrast, depending on the extent to which palladium supply and demand decline, the market could remain in a small deficit, become balanced or move into a surplus.

因此,对2020年铂钯市场的预测变得更加具有挑战性。在目前阶段,铂族金属需求的下降可能会超过供应下降,尤其是在钯金方面。此外,由于铂金存在严重的供过于求,在2020年,这种情况很可能会继续存在。相比之下,根据钯金供需下降的程度,市场可能会保持小幅赤字,趋于平衡,或出现盈余。

Our projections for the palladium and platinum are based on the latest figures released by LMC automotive, released in early April. The consultancy now forecasts global light vehicle sales will decline by 14% in 2020, with losses seen across all regions. Based on these inputs, our model suggests that global palladium autocatalyst demand will fall by 11% and platinum demand by 11%, to 249t and 82t.

根据LMC automotive 4月初发布的最新数据,在2020年,全球轻型汽车销量将下降14%,所有地区都将出现亏损。基于这些数据,我们预测:全球的钯催化剂需求将下降11%,铂需求将下降11%,分别为249吨和82吨。

As far as PGM mine supply is concerned, we have made allowances for disruptions related to the 21-day national lock-down that is currently underway in South Africa. The country represents 73% of global platinum and 37% of palladium supply. Outside South Africa, most PGM mining operations are currently continuing relatively undisrupted. Finally, it is worth noting that we have adjusted down our autocatalyst recycling projections to allow for lower scrappage of old cars, as consumers refrain from renewing their vehicle in the face of economic uncertainties.

铂族金属矿供应方面,南非占全球铂供应量的73%,钯供应量的37%,目前该国正在进行为期21天的全国封锁,从而造成了供应的中断。在南非以外,大多数铂族金属采矿业务仍在正常有序的进行。最后,值得注意的是,由于消费者面临经济的不确定性而不愿更换汽车,我们调整了汽车尾气催化剂回收的预测,以降低其中的旧车报废率。

Combining the above with our forecasts for other areas of demand and recycling suggests that the palladium market will remain in a small deficit in 2020 overall, while platinum stays in a surplus. As far as prices are concerned, in the near term there are considerable down-side risks for both metals, particularly as it is likely that mine production capacity will come back on-stream faster than automotive demand will. Later in the year however, we expect both palladium and platinum prices to recover. In the case of palladium this will be fuelled by signs of improving fundamentals while for platinum it will be due to its like to gold and the strong performance of the yellow metal we predict.

我们将上述数据与其它需求和回收领域的预测相结合,从而预测: 2020年钯金市场总体上仍将保持少量短缺,而铂市场将保持供大于求。就市场价格而言,在短期内,这两种金属都存在相当大的下行风险,尤其是矿山生产能力的恢复速度很可能快于汽车需求的恢复速度。但是,我们预计:今年晚些时候,钯和铂的价格都将回升。其中,钯金将受到基本面改善迹象的推动,而铂金将由于其与黄金的相似而受到其强劲表现的推动。

(2020年国际铂钯价格预测报告)

微信扫描下方二维码关注中国白银网官方公众号,获取更多信息!

(中国白银网)