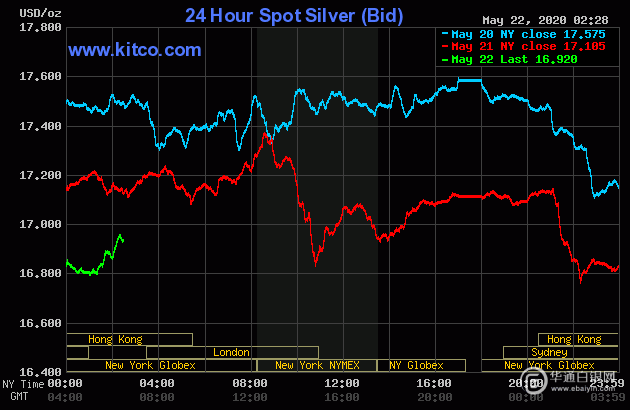

Gold and silver prices are lower in midday U.S. dealings Thursday, on routine downside corrections following recent gains. Some profit-taking from the shorter-term futures traders was also featured today. A rebound in the U.S. dollar indextoday was also a negative daily element for the metals. Once again, it appears the two metals are tracking the U.S. stock indexes, which are lower at midday. June gold futureswere last down $27.00 an ounce at $1,725.00. July Comex silver prices were last down $0.556 at $17.47 an ounce.

周四美国市场午盘,黄金和白银价格走低,在近期上涨后出现常规下行修正。今日主要受短线投资者获利回吐影响。美元指数反弹也是打压贵金属的主要因素,这两种金属似乎再一次追随午盘走低的美国股指。6月黄金期货最新跌27.00美元,报1725.00美元。7月纽约商品期货交易所白银价格下跌0.556美元,报17.47美元

Attitudes overall are still generally upbeat late this week as governments continue to reopen businesses that had been shuttered for weeks. Some sporting events have been scheduled to resume in the coming weeks and there are rising hopes autumn sports can be played.

本周晚些时候,随着政府继续重开关闭了数周的企业,人们的总体上仍然乐观态度。一些体育赛事将在未来几周内恢复,秋季比赛的希望也越来越大

Also supporting more positive trader and investor sentiment is the surprising rally in crude oil prices that sees Nymex crude oil trading above $34.00 a barrel Thursday morning. The strong rally in the oil market has caught most oil market watchers by surprise, given significantly reduced demand and still-burdensome global supplies. Just a few weeks ago Nymex May crude oil futures traded as low as -$40 a barrel just before the contract expired.

支撑绝大多数交易商和投资者信心的另一个因素是,原油价格意外上扬,纽约商品交易所周四上午原油交易价突破每桶34.00美元。石油市场的强劲反弹令大多数石油市场观察者感到意外,因为需求大幅下降和全球石油供应仍然没用解决。就在几周前,纽约商品交易所5月份原油期货价格还低至每桶-40美元,直到合约到期。

Global economic data for May is starting to improve from the dire numbers seen in April. The IHS Markit composite purchasing managers index (PMI) for May in the Euro zone rose to 30.5 in May from 13.6 in April. A reading below 50.0 suggests contraction. The U.K.’s PMI for the same period came in at 28.9 from 13.8. Japan’s PMI for the same period was 27.4 versus 25.8. Australia’s composite May PMI was 36.4 versus 21.7 in April.

5月份的全球经济数据开始好于4月份的糟糕数据。5月欧元区IHS Markit采购经理人指数(PMI)从4月的13.6升至30.5。低于50.0意味着经济萎缩。 英国美国制造业PMI为28.9,高于上年同期的13.8。日本的PMI为27.4,而同期为25.8。澳大利亚5月份综合PMI为36.4,低于4月份的21.7。

The other important outside markets see the yield on the benchmark U.S. Treasury 10-year note is currently around 0.67%.

其他重要的外部市场则认为,美国基准10年期国债的收益率目前约为0.67%

Technically, June gold futures saw no chart damage occur today. The bulls still have the solid overall near-term technical advantage. Gold bulls' next upside near-term price objective is to produce a close above solid technical resistance at the April high of $1,788.80. Bears' next near-term downside price objective is pushing prices below solid technical support at $1,666.20. First resistance is seen at $1,735.00 and then at today’s high of $1,751.70. First support is seen at today’s low of $1,715.30 and then at $1,700.00. Wyckoff's Market Rating: 7.5

从技术上看,6月份黄金期货今天没有出现图表损失。看涨者仍拥有坚实的短期技术优势。黄金多头的下一个近期上行目标是在4月高位1,788.80美元上方形成坚实的技术阻力位。空头的下一个短期下跌目标是将价格推低至1.666.20美元的坚实技术支撑位。首先在1.735.00美元见阻力位,然后在今日高位1.751.70美元见阻力位。今天首先支撑位在的低点1,715.30美元,然后在1,700美元。Wyckoff市场评级:7.5

July silver futures saw a corrective and profit-taking pullback after hitting a nearly three-month high Wednesday. The silver bulls still have the firm overall near-term technical advantage. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the February high of $19.07 an ounce. The next downside price breakout objective for the bears is closing prices below solid support at $16.50. First resistance is seen at $18.00 and then at this week’s high of $18.165. Next support is seen at today’s low of $17.26 and then at $17.00. Wyckoff's Market Rating: 7.0.

7月白银期货在周三触及近三个月高位后出现修正和获利回吐回调。白银的技术分析短期看涨,白银多头的下一个目标是在2月触及的19.07美元/盎司的技术阻力位。看跌者的下一个下跌突破目标是收盘价低于16.50美元的支撑位。首先在18.00美元见阻力位,然后在本周高位18.165美元见阻力位。下一个支撑位在今天的低点17.26美元,然后是17.00美元。Wyckoff的市场评级:7.0。

July N.Y. copper closed down 295 points at 243.05 cents today. Prices closed nearer the session low today and on profit taking after hitting a two-month high early on today. The copper bulls have the overall near-term technical advantage. Prices are in a two-month-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 255.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 230.00 cents. First resistance is seen at today’s high of 246.80 cents and then at 250.00 cents. First support is seen at 240.00 cents and then at 237.50 cents. Wyckoff's Market Rating: 6.5.

纽约7月期铜今日下跌295点,报243.05美分,在触及两个月高位后获利回吐,今日触及日低。期铜的近期技术分析看涨。在日线图上,铜价正处于两个月的上升通道中。多头的下一个上行目标是推动价格突破255.00美分的技术阻力位。空头的下一个下跌目标是收盘价格低于230.00美分的技术支撑。第一个阻力位在今天的高位246.80美分,然后在250.00美分。支撑位首先是240.00美分,然后是237.50美分。

编辑:Jim Wyckoff

来源:Kitco

(中国白银网编译)